How Do I Send Cryptocurrency To Someone?

Sending cryptocurrency to someone can seem like a daunting task, but it’s actually quite straightforward. Whether you’re new to the world of digital currencies or a seasoned investor, understanding the process can help you navigate this exciting realm with ease. In this article, we’ll explore the step-by-step process of sending cryptocurrency to someone and unravel any confusion you may have along the way. So, grab your digital wallets and let’s get started on this cryptocurrency sending adventure!

Choosing a Cryptocurrency Wallet

What is a cryptocurrency wallet?

A cryptocurrency wallet is a digital tool that allows you to securely store, send, and receive cryptocurrencies. Think of it as a virtual wallet for your digital assets. It consists of a pair of cryptographic keys: a public key, which is used to receive funds, and a private key, which is used to sign transactions and access your funds. Choosing the right cryptocurrency wallet is crucial in ensuring the security and convenience of your digital assets.

Types of cryptocurrency wallets

There are several types of cryptocurrency wallets available, each with its own advantages and considerations:

-

Hardware Wallets: These wallets store your private keys offline, in a physical device such as a USB stick. They offer enhanced security since they are not connected to the internet when not in use. Examples include Trezor and Ledger wallets.

-

Software Wallets: These wallets are digital applications or programs that can be installed on your computer or smartphone. They can be further categorized into:

-

Desktop Wallets: Installed on your computer, these wallets provide full control over your private keys and offer a higher level of security compared to online wallets. Examples include Exodus and Electrum.

-

Mobile Wallets: Designed for mobile devices, these wallets are convenient for everyday use and allow you to access your cryptocurrencies on the go. Examples include Trust Wallet and Mycelium.

-

Web Wallets: These wallets operate on the cloud and can be accessed through a web browser. They offer easy access and are suitable for small transactions but may involve a higher security risk compared to other types of wallets. Examples include MetaMask and Blockchain.com.

-

-

Paper Wallets: Paper wallets are physical copies of your public and private keys, usually generated offline. They offer an extra level of security since they are offline and cannot be hacked remotely. However, they require careful storage and protection against physical damage or loss.

Factors to consider when choosing a wallet

When selecting a cryptocurrency wallet, keep the following factors in mind:

-

Security: The security of your digital assets should be your top priority. Look for wallets that offer features like two-factor authentication (2FA), multi-signature functionality, and encryption to safeguard your private keys.

-

User-Friendliness: Consider the wallet’s user interface and ease of use. A wallet with an intuitive interface and clear instructions can make managing your cryptocurrencies much simpler and more convenient.

-

Compatibility: Ensure that the wallet supports the cryptocurrencies you plan to use. Some wallets are designed for specific cryptocurrencies, while others offer multi-currency support. Check if the wallet integrates with the platforms and exchanges you intend to use.

-

Development Team Reputation: Do some research on the wallet’s development team. Look for wallets with active and reputable development teams that regularly release security updates and address any vulnerabilities.

-

Community Trust and Reviews: Seek feedback from the cryptocurrency community and read reviews to gauge the overall user experience and reliability of the wallet. Consider wallets that have a strong and trustworthy reputation among users.

-

Backup and Recovery Options: It is crucial to have a backup plan to protect against the loss of your private keys. Look for wallets that offer backup and recovery features, such as seed phrases or mnemonic phrases, which can be used to restore access to your funds in case of device loss or damage.

By considering these factors, you can choose a cryptocurrency wallet that aligns with your needs and priorities.

Getting the Recipient’s Wallet Address

What is a wallet address?

A wallet address, also known as a public key, is a unique alphanumeric string that represents the destination for a cryptocurrency transaction. It acts as the recipient’s identifier, ensuring that the funds are sent to the correct destination.

Different ways to obtain a wallet address

To obtain a wallet address, you can:

-

Create a Wallet: If the recipient does not have a wallet yet, they can create one using a reliable cryptocurrency wallet provider. This typically involves selecting the type of wallet, generating a new wallet address, and securing the private key.

-

Share Existing Wallet Address: If the recipient already has a wallet, they can share their existing wallet address with you. Most wallets provide a simple way to copy or share the public key, usually in the form of a QR code or a text string.

-

Use Payment Gateways or Invoicing Systems: Some platforms, especially those involved in e-commerce, provide payment gateways and invoicing systems that generate unique wallet addresses for each transaction. If you are making a payment on such a platform, the recipient’s wallet address will be automatically provided to you.

Double-checking the address

Before sending any funds, it is crucial to double-check the recipient’s wallet address to ensure accuracy. Cryptocurrency transactions are irreversible, and sending funds to an incorrect address may result in permanent loss.

To verify the address, consider cross-referencing it through multiple sources. Verify the first and last few characters of the address, compare it with previously used addresses by the recipient, or use a QR code scanner to ensure there are no typos or malicious modifications.

Taking a few extra seconds to double-check the wallet address can save you from potential mistakes and ensure your funds reach the intended recipient safely.

Selecting a Cryptocurrency Exchange

What is a cryptocurrency exchange?

A cryptocurrency exchange is a platform that allows users to buy, sell, and trade cryptocurrencies. It serves as an intermediary between buyers and sellers, providing a marketplace for exchanging digital assets. When sending cryptocurrency to someone, you may need to use a cryptocurrency exchange to convert your funds into the recipient’s desired currency.

Popular cryptocurrency exchanges

There are numerous cryptocurrency exchanges available, each with its own features, fees, and supported currencies. Some popular exchanges include:

-

Binance: Binance is one of the largest and most widely used cryptocurrency exchanges globally. It offers a wide range of cryptocurrencies for trading and has a user-friendly interface.

-

Coinbase: Coinbase is a popular exchange known for its simplicity and ease of use, especially for beginners. It supports several major cryptocurrencies and provides a secure wallet for storing your digital assets.

-

Kraken: Kraken is a reputable exchange that offers advanced trading features and high liquidity. It has a strong focus on security and compliance with regulations.

-

Bitstamp: Bitstamp is one of the oldest cryptocurrency exchanges and is known for its robust security measures. It supports various cryptocurrencies and offers competitive trading fees.

These are just a few examples, and there are many other exchanges available to choose from. When selecting a cryptocurrency exchange, consider factors such as security measures, user experience, supported currencies, trading fees, and transaction speed.

Creating an account on an exchange

To use a cryptocurrency exchange, you typically need to create an account. The account creation process may vary slightly between exchanges, but generally, it involves the following steps:

-

Sign-Up: Visit the exchange’s website and click on the “Sign-Up” or “Register” button. Provide the required information, including your email address, a secure password, and sometimes personal identification details to comply with Know Your Customer (KYC) regulations.

-

Verify Your Account: Some exchanges require users to complete a verification process to comply with anti-money laundering (AML) regulations. This may involve providing additional identification documents, such as a passport or driver’s license, and proof of address.

-

Enable Two-Factor Authentication (2FA): Set up 2FA to add an extra layer of security to your exchange account. This typically involves associating your account with a mobile app such as Google Authenticator or receiving SMS codes for verification.

-

Deposit Funds: Once your account is verified, you can deposit funds into your exchange account. Different exchanges support various deposit methods, including bank transfers, credit/debit cards, or cryptocurrency transfers from an external wallet.

By following these steps, you can create an account on a cryptocurrency exchange and prepare to send cryptocurrency to someone.

Linking Your Wallet to the Cryptocurrency Exchange

Connecting your wallet to the exchange

When sending cryptocurrency from your wallet to someone else, you need to link your wallet to the cryptocurrency exchange. This allows you to access your wallet and initiate the transaction directly from the exchange.

To connect your wallet to the exchange, you typically need to follow these steps:

-

Find the Wallet Settings: Locate the wallet settings or preferences section on the exchange platform. This may be labeled as “Wallets,” “Assets,” or something similar.

-

Add Wallet: Within the wallet settings, look for an option to add a new wallet. It may be listed as “Add Wallet,” “Link Wallet,” or something similar.

-

Select Wallet Type: Choose the type of wallet you are linking, such as hardware wallet, software wallet, or web wallet.

-

Follow Instructions: Depending on the wallet type, you may need to follow specific instructions provided by the exchange to establish the connection. This could involve connecting your wallet physically (for hardware wallets) or authorizing the connection through an API key (for software and web wallets).

By linking your wallet to the cryptocurrency exchange, you can seamlessly transfer funds from your wallet to the recipient’s wallet without the need for manual transactions.

Importing or exporting your wallet

In some cases, you may need to import or export your wallet within the cryptocurrency exchange. This typically occurs when you are switching wallets or using a different device for accessing your digital assets.

To import or export your wallet, follow these steps:

-

Locate the Wallet Import/Export Function: Depending on the exchange, this function may be located in the wallet settings or preferences section.

-

Export Wallet: If you want to export your wallet from the exchange, find the option to export the wallet. This will usually create a file containing your wallet data, such as the private key or recovery phrase. Ensure you store this file securely and make multiple backups.

-

Import Wallet: To import your wallet into the exchange, look for the option to import a wallet. This will usually require you to provide the wallet data, such as the private key or recovery phrase. Follow the instructions provided by the exchange to complete the import process.

By importing or exporting your wallet, you can easily transfer your digital assets between different platforms or devices while maintaining control over your funds.

Wallet compatibility with exchanges

Not all cryptocurrency wallets are compatible with every exchange. When choosing a wallet, ensure that it is compatible with the exchange you plan to use. Some exchanges support a wide range of wallets, while others may have restrictions or limitations.

Read the documentation or support pages of both the wallet and exchange to determine if they can be linked or if any special configurations are required. This will help prevent any compatibility issues and ensure a smooth transfer of funds.

Adding Funds to Your Exchange Account

Methods to add funds to your account

Before you can send cryptocurrency to someone, you need to have funds in your exchange account. There are several methods available to add funds to your account, including:

-

Cryptocurrency Deposits: If you already own cryptocurrencies, you can transfer them directly into your exchange account. Generate a deposit address within the exchange and initiate a transfer from your wallet to that address. Depending on the cryptocurrency network, the transfer may take some time to complete.

-

Bank Transfers: Many exchanges support bank transfers for depositing funds. Simply initiate a transfer from your bank account to the provided bank account details of the exchange. Be aware that bank transfers may incur additional processing time, usually determined by your bank and the exchange.

-

Credit/Debit Card Payments: Some exchanges allow you to add funds to your account using credit or debit cards. This method offers instant availability of funds, enabling you to start sending cryptocurrency right away. However, be mindful of any associated processing fees when using this payment method.

Linking bank accounts or credit cards

When adding funds to your exchange account through bank transfers or credit/debit card payments, you may need to link your bank account or credit card to the exchange. This is typically a one-time process and might involve the following steps:

-

Locate Account Settings: Find the account settings or preferences section on the exchange platform.

-

Add Payment Method: Within the account settings, look for an option to add a new payment method. This may be labeled as “Bank Account,” “Credit/Debit Card,” or something similar.

-

Provide Details: Follow the instructions to input the required information, such as bank account details or credit card information. Ensure the information provided is accurate to avoid any issues with deposits or withdrawals.

-

Verification: Depending on the exchange requirements, you may need to verify your payment method. This could involve confirming small deposits made by the exchange into your bank account or validating your credit card through a verification code.

By linking your bank account or credit card, you can conveniently add funds to your exchange account for seamless cryptocurrency transactions.

Fees associated with depositing funds

It is important to be aware of any fees associated with depositing funds into your exchange account. Different exchanges have varying fee structures, and these fees can depend on the deposit method used.

When adding funds, check the exchange’s fee schedule or FAQ section to determine if there are any charges. Some exchanges may charge a percentage-based fee, while others may have a fixed fee. Additionally, some banks or credit card companies may also impose their own fees for processing the transaction.

By understanding the fees involved, you can plan accordingly and ensure that your transferred funds are not significantly impacted by additional charges.

Choosing the Amount and Currency to Send

Determining the amount to send

Before initiating a cryptocurrency transaction, it is essential to determine the amount you want to send. Consider factors such as the intended purpose, current market value of the cryptocurrency, and any associated transfer fees.

Take into account the recipient’s requirements or expectations regarding the amount. If you are sending a specific amount of currency, ensure that the quantity accurately matches the recipient’s request.

Ensure that you have enough funds available in your exchange account or linked wallet to cover the amount you plan to send.

Selecting the correct cryptocurrency

Choosing the correct cryptocurrency to send is crucial to ensure that the recipient can access and utilize the funds. Different cryptocurrencies have different blockchain networks and are not always compatible with each other.

Confirm with the recipient which specific cryptocurrency they accept or prefer. Ensure that your wallet or exchange account supports the chosen cryptocurrency for a hassle-free and successful transaction.

When selecting a cryptocurrency, be mindful of any conversion fees or exchange rates if you are sending a different cryptocurrency than the one stored in your wallet or exchange account.

Considering transaction fees

Most cryptocurrency transactions involve transaction fees, which are paid to the network miners for verifying and processing the transaction. The fees can vary based on network congestion, transaction size, and priority.

Consider the current transaction fees associated with the cryptocurrency you are sending. Higher fees may result in faster transaction confirmations, while lower fees may lead to delayed confirmations.

Research the fee structure of your wallet or exchange platform, and if applicable, adjust the transaction fee according to your desired speed and cost.

By considering the amount to send, the correct cryptocurrency, and any associated transaction fees, you can ensure a smooth and satisfactory transfer of funds.

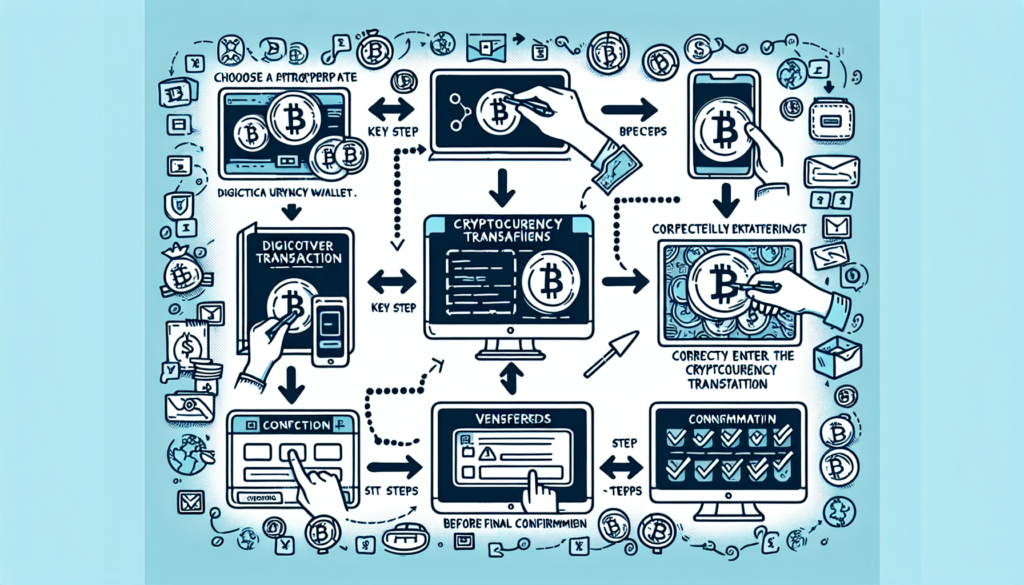

Initiating the Transaction

Finding the ‘Send’ or ‘Transfer’ option

To initiate a cryptocurrency transaction, locate the ‘Send’ or ‘Transfer’ option on your wallet or exchange platform. This option is used to specify the recipient’s wallet address and the amount of cryptocurrency you want to send.

In most wallets, you can find the ‘Send’ or ‘Transfer’ option within the wallet dashboard or account settings. On exchange platforms, this option is usually available within the trading or account sections.

Take your time to locate this option, ensuring you understand the process and any additional steps that may be required.

Inputting the recipient’s wallet address

Once you have found the ‘Send’ or ‘Transfer’ option, you will be prompted to input the recipient’s wallet address. Copy and paste the recipient’s wallet address into the designated field to avoid any typographical errors.

Some wallets also provide a QR code scanning feature, allowing you to scan the recipient’s wallet address instead of manually inputting it. This adds an extra layer of security and convenience.

Ensure that you have double-checked the recipient’s wallet address to avoid sending funds to the wrong destination.

Verifying transaction details

Before sending cryptocurrency, it is critical to verify the transaction details, as cryptocurrency transactions are irreversible. Carefully review the following information:

-

Recipient’s Wallet Address: Ensure that the recipient’s wallet address is accurate and matches the intended recipient.

-

Amount to Send: Confirm that the selected amount is correct and aligns with the recipient’s expectations. Consider any applicable fees.

-

Transaction Fee: Check the transaction fee applied to the transfer. Ensure it aligns with your expectations in terms of speed and cost.

-

Network Confirmations: Some cryptocurrencies require a certain number of network confirmations to consider the transfer as successful. Be prepared to wait until the required number of confirmations is reached.

By verifying these details, you can minimize the risk of sending funds to the wrong address or with incorrect amounts.

Confirming the Transaction

Reviewing transaction details

Before confirming a cryptocurrency transaction, carefully review the transaction details provided by your wallet or exchange platform. This includes the recipient’s wallet address, the amount to send, transaction fee, and any additional notes or memos.

Make sure that all the information is accurate and aligns with your intentions. If you notice any discrepancies or errors, stop the transaction and recheck the details. Once the transaction is confirmed, it cannot be reversed or modified.

Entering any necessary security credentials

To ensure the security of your funds, you may need to enter additional security credentials when confirming a transaction. This could include providing your password, confirming a two-factor authentication (2FA) code, or authorizing the transaction through a separate verification method.

Follow the instructions provided by your wallet or exchange platform to complete the security verification process and proceed with the transaction.

Confirming the transaction

Once you have verified the transaction details and provided any necessary security credentials, you can confirm the transaction. Depending on the wallet or exchange platform, this may involve clicking a “Confirm” or “Send” button, or providing final authorization through another verification step.

Once confirmed, the transaction will be broadcasted to the cryptocurrency network and will undergo validation and processing by miners. The time it takes for a transaction to be confirmed can vary depending on network congestion and other factors.

After confirming the transaction, make sure to keep track of its progress to ensure the successful delivery of your funds.

Tracking the Transaction

Understanding transaction confirmations

A transaction confirmation refers to the process of validating and finalizing a cryptocurrency transaction on the blockchain network. Each confirmation signifies that a certain number of network nodes have verified and approved the transaction.

Confirmations serve as a measure of the transaction’s reliability and security. The more confirmations a transaction receives, the less likely it is to be reversed or considered invalid.

The number of confirmations required can vary depending on the cryptocurrency and the recipient’s risk tolerance. While some transactions may be considered secure after just a few confirmations, others may require a higher number before being considered fully confirmed.

Using blockchain explorers to track transactions

Blockchain explorers are online tools that allow you to view and track transactions on the blockchain. They provide detailed information about each transaction, including transaction ID, sender and recipient addresses, transaction status, and confirmations.

To track your cryptocurrency transaction, copy the transaction ID (also known as the transaction hash) from your wallet or exchange platform and enter it into a blockchain explorer specific to the cryptocurrency you sent. The explorer will display real-time information about your transaction, including its current status and number of confirmations.

Blockchain explorers are popularly available for major cryptocurrencies like Bitcoin, Ethereum, and Litecoin. They provide transparency and allow you to monitor the progress and confirmation status of your transaction.

Monitoring the transaction in your wallet

In addition to using blockchain explorers, many cryptocurrency wallets provide built-in transaction monitoring features. These features allow you to track the progress and status of your transaction directly within the wallet interface.

Check your wallet’s transaction history or activity section to find details about the sent transaction. Here, you can typically find information like the date and time of the transaction, the recipient’s wallet address, the amount sent, and the corresponding transaction ID.

By monitoring the transaction within your wallet, you can easily keep track of its progress and confirmations without the need to rely on external tools or platforms.

Ensuring Security in Cryptocurrency Transactions

Implementing two-factor authentication

Two-factor authentication (2FA) is a security measure that adds an extra layer of protection to your cryptocurrency transactions. It requires you to provide a second verification factor, in addition to your password, to access your wallet or exchange account.

Enable 2FA on your wallet and exchange accounts by following the instructions provided by the respective platforms. This often involves associating your account with a mobile app like Google Authenticator or receiving SMS codes for verification.

By implementing 2FA, you add an extra barrier that hackers must overcome to gain unauthorized access to your funds.

Using hardware wallets for added security

Hardware wallets are physical devices specifically designed to store cryptocurrency private keys securely. These wallets keep your private keys completely offline, reducing the risk of online attacks or hacks.

Consider using a hardware wallet, such as Trezor or Ledger, to store your cryptocurrencies, especially if you hold a significant amount of digital assets. Hardware wallets offer robust security features, including encryption, PIN codes, and built-in displays for confirming transactions.

By using a hardware wallet, you can significantly enhance the security of your cryptocurrency transactions and protect your funds from potential cyber threats.

Being cautious of phishing attempts

Phishing attempts are prevalent in the world of cryptocurrencies. Scammers often target individuals with fake websites, emails, or messages, attempting to steal sensitive information such as wallet passwords or private keys.

Take caution and follow these measures to avoid falling victim to phishing attempts:

-

Verify Website URLs: Ensure that the website address of your wallet or exchange matches the official website. Beware of links received through emails, social media, or other messaging platforms, as they may redirect you to fraudulent websites.

-

Double-Check Emails and Messages: Be skeptical of unsolicited emails or messages that prompt you to click on links or provide sensitive information. Legitimate wallets and exchanges typically do not ask for such information through email or messaging platforms.

-

Enable Email and Account Notifications: Set up account notifications on your wallet or exchange account to receive alerts for any suspicious activities. This can help you stay informed and take immediate action if any unauthorized access is detected.

-

Educate Yourself: Stay updated with the latest security practices and news in the cryptocurrency space. Familiarize yourself with common phishing techniques and learn to identify potential scams.

By staying vigilant and following best security practices, you can minimize the risk of falling prey to phishing attempts and keep your cryptocurrencies safe.

In conclusion, sending cryptocurrency to someone requires careful consideration and adherence to important steps. From choosing the right wallet to confirming the transaction, each stage plays a crucial role in ensuring a successful and secure transfer of funds. By understanding the fundamentals and implementing necessary security measures, you can confidently send cryptocurrency and participate in the exciting world of digital finance.